Renishaw Plc is a prominent player in the fields of engineering, manufacturing, and metrology. The company is known for its innovative precision measurement devices and its expanding presence in healthcare solutions. As Renishaw’s stock continues to attract investor interest, it’s important to understand the factors affecting its price and performance. In this guide, we’ll break down the latest trends, key influences, and everything you need to know about Renishaw’s stock price.

What Does Renishaw Do?

Before we look at Renishaw’s stock price, let’s take a closer look at what the company does and why its business model impacts its market performance.

Founded in 1973 and based in Gloucestershire, UK, Renishaw is primarily involved in two sectors:

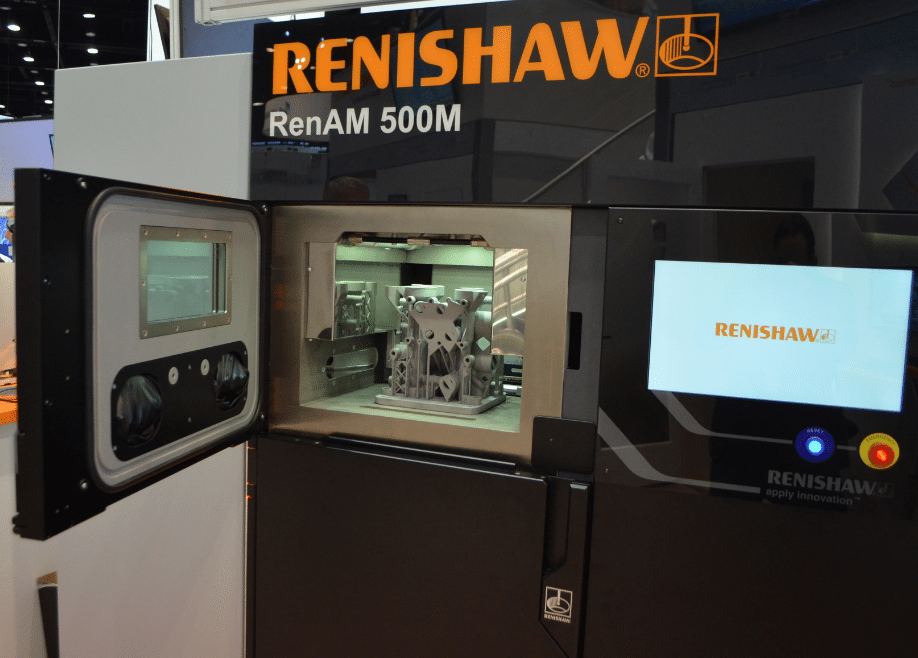

Metrology: Renishaw is a leading designer and manufacturer of high-precision measurement systems used in industries like aerospace, automotive, and electronics. These tools are crucial for ensuring accuracy in the production of parts and components.

Healthcare: The company also develops medical technologies, focusing on areas like robotic surgery and 3D printing for medical devices. Renishaw’s healthcare products aim to improve precision in treatments like dental surgeries and neurosurgery.

Renishaw’s broad range of products and its commitment to innovation gives it a unique position in the market, helping it stay competitive across different sectors.

The Latest Renishaw Stock Price: Key Insights

As of January 2025, Renishaw’s stock is trading at around £4,700 per share. This price reflects the company’s strong reputation and premium position in the market. It’s important to note that Renishaw is considered a mid-to-large-cap stock, making it more suitable for investors with a higher risk tolerance.

Recent Stock Performance

Renishaw’s stock has experienced both growth and volatility in recent months. Some of the key factors affecting its price include:

Positive Earnings Reports: Renishaw has seen steady revenue growth, particularly driven by demand for its precision measurement systems and healthcare products. This has helped boost investor confidence and slightly raised the stock price.

Economic Challenges: Like many companies in the tech sector, Renishaw has faced challenges such as inflation, currency fluctuations, and supply chain disruptions. These factors can cause short-term stock price swings and influence long-term investor outlook.

Healthcare Growth: Renishaw’s healthcare division, especially in robotic surgery and medical 3D printing, has attracted significant interest from investors, helping to boost stock performance.

Factors That Influence Renishaw Stock Price

Several key factors drive Renishaw’s stock price, from company-specific developments to broader market conditions. Here are the most important ones:

Earnings and Profitability

Renishaw’s earnings reports, which provide details on revenue, margins, and profits, are crucial for investors. Strong financial performance typically results in a rise in stock price, while weaker results can lead to declines.

Product Innovation

Renishaw’s focus on innovation is a major driver of stock performance. New product releases or breakthroughs in precision technology, such as advancements in robotic surgery or 3D printing, can have a significant positive impact on the stock.

Global Economic Conditions

Economic factors like inflation, interest rates, and geopolitical events can influence Renishaw’s stock price. For instance, global supply chain issues can affect the company’s ability to produce and deliver products on time, impacting both revenue and stock performance.

Competition

Renishaw faces competition in both its metrology and healthcare divisions. Competitors like Hexagon AB and ZEISS in metrology, or Intuitive Surgical and Medtronic in healthcare, can influence Renishaw’s market share and stock price.

Regulatory Environment

Especially in the healthcare sector, regulatory approval is crucial. Delays or issues in obtaining approvals for new medical technologies can negatively impact Renishaw’s stock. Additionally, changes in healthcare regulations, especially in the UK and Europe, can affect business operations.

Renishaw Stock: Historical Trends

Looking at Renishaw’s stock price over the years reveals a few notable trends:

Pre-2017 Growth: Before 2017, Renishaw’s stock experienced steady growth, driven by strong demand for its measurement tools and growing influence in the healthcare sector.

2017-2020 Volatility: During this period, the stock faced volatility due to political uncertainties like Brexit and the US-China trade war. These events created a challenging environment, even though Renishaw continued to perform well financially.

Post-COVID Recovery: After the pandemic, Renishaw saw a significant rebound, with increased demand for automation and medical technologies. The stock began to climb again as investors anticipated long-term growth.

2023-2024 Stabilization: In recent years, the stock has shown signs of stabilization. Analysts are focusing on whether Renishaw can continue to grow in a competitive and cost-conscious environment.

Should You Invest in Renishaw Stock?

Before deciding to invest, it’s important to weigh the potential rewards and risks.

Opportunities:

Strong Market Position: Renishaw is a leader in precision measurement and healthcare technologies, offering strong growth potential, especially as industries continue to adopt automation and precision engineering.

Healthcare Growth: The healthcare division is a major opportunity. As the global healthcare market grows, Renishaw’s cutting-edge products, like robotic surgery systems and medical 3D printing, could drive significant upside.

Risks:

Economic Volatility: Renishaw, like other tech companies, faces risks related to inflation, currency fluctuations, and supply chain disruptions. These factors could affect the company’s financial performance and stock price.

Competition: Renishaw operates in highly competitive sectors. The need to innovate and maintain market share against other major players could impact its stock price.

A Closing Perspective

Renishaw’s stock price reflects the company’s strong market position and innovation, particularly in metrology and healthcare. While the company has shown resilience through economic challenges, investors should be mindful of risks such as competition, economic volatility, and regulatory changes.

As of early 2025, Renishaw’s stock remains a premium option for investors interested in high-tech sectors, especially those focusing on automation and healthcare. However, as with any investment, it’s important to conduct thorough research and consider consulting a financial advisor before making any decisions.

FAQs:-

What is the current Renishaw stock price?

The current stock price of Renishaw can fluctuate daily depending on market conditions. To get the most up-to-date information, you can check financial news platforms like Bloomberg, and Reuters, or stock tracking websites such as Yahoo Finance and Google Finance. You can also look at real-time data on your brokerage platform.

Why has Renishaw’s stock price been volatile recently?

Stock price volatility can occur for various reasons, including:

Market Conditions: Broader market trends, economic reports, or geopolitical events.

Company Performance: Changes in revenue, profits, or new product launches can influence investor sentiment.

Industry Trends: Renishaw operates in precision measurement and healthcare, sectors that may face rapid innovation, regulation changes, or competitive pressures.

Acquisitions or Strategic Changes: Announcements related to mergers, acquisitions, or leadership changes can lead to short-term volatility.

Is Renishaw stock a good investment?

As with any investment, determining if Renishaw is a “good” investment depends on your financial goals, risk tolerance, and market outlook. Historically, Renishaw has been considered a strong performer in the precision engineering industry, but stock prices are subject to fluctuations. Conducting a thorough analysis, considering both company fundamentals and market conditions, is essential. You may also consult a financial advisor for personalized advice.

To read more, Click Here